Market Recap: January 2026

Market commentary

- Economic growth remains solid, driven by productivity gains — especially from AI and technology — that lift output without raising inflationary pressure or employment.

- Inflation remains elevated but manageable, with tariff-related pressures offsetting slower progress toward the Fed’s 2% core target.

- The U.S. labor market is mixed, with weak job growth, cooling wages, and rising long-term unemployment despite a stabilizing headline jobless rate.

- The 2026 outlook is cautiously constructive, favoring continued growth over recession as productivity improves, inflation eases, and rate-sensitive sectors stabilize.

Select economic and market data

Statistic (monthly unless noted) |

Current |

Previous |

|---|---|---|

| U.S. GDP (quarterly) | 4.4% | 3.8% |

| Consumer Confidence | 84.5 | 94.2 |

| Consumer Price Index Y/Y | 2.7% | 2.7% |

| Core PCE (x food & energy) | 2.8% | 2.7% |

| ISM Manufacturing Index | 52.6 | 47.9 |

| Unemployment Rate | 4.4% | 4.5% |

| 2-Year Treasury Yield | 3.52% | 3.48% |

| 10-Year Treasury Yield | 4.24% | 4.17% |

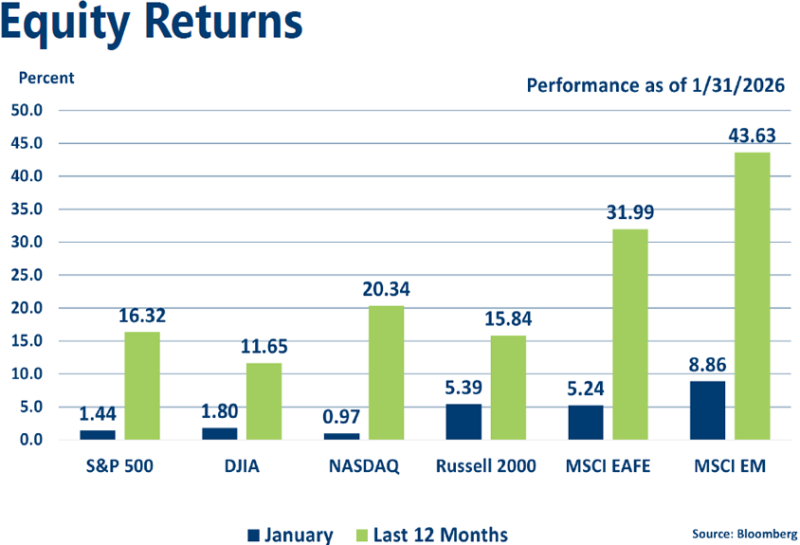

Equities

- Markets opened 2026 higher but choppy, with new highs, broader participation, rotation out of mega-cap tech, and volatility driven by the Fed, earnings, and geopolitics.

- Non-U.S. equities delivered material outperformance versus U.S. markets, extending the diversification trend underway since mid-2025.

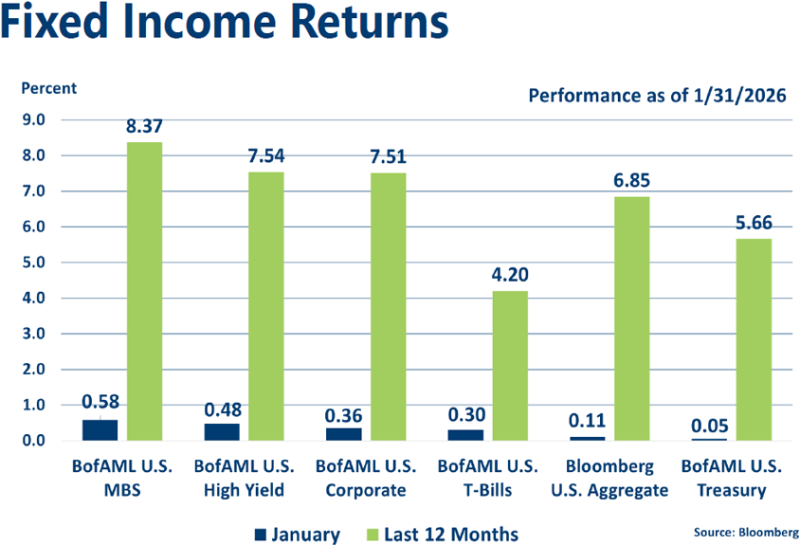

Fixed income

- The Fed appears to be in a holding pattern, with policy near neutral (3.5%–3.75%) and reduced urgency to cut until inflation and labor data become clearer.

- Stable Treasury yields and tighter credit spreads led corporates and mortgages to modestly outperform in January.

Strategic outlook

- Some caution warranted on equities in the near-term, particularly in large-cap stocks with above-average valuations; currently favoring small-cap and mid-cap domestic stocks longer-term.

- Near-average expected returns projected for fixed income with the Fed on pause and rates reflective of economic conditions.

- Above-average volatility is likely given central bank involvement and geopolitical uncertainty.

|

Learning Center articles, guides, blogs, podcasts, and videos are for informational purposes only and are not an advertisement for a product or service. The accuracy and completeness is not guaranteed and does not constitute legal or tax advice. Please consult with your own tax, legal, and financial advisors.